What I read this week

Unemployment, housing, and the usual warnings about bubbles...

Articles

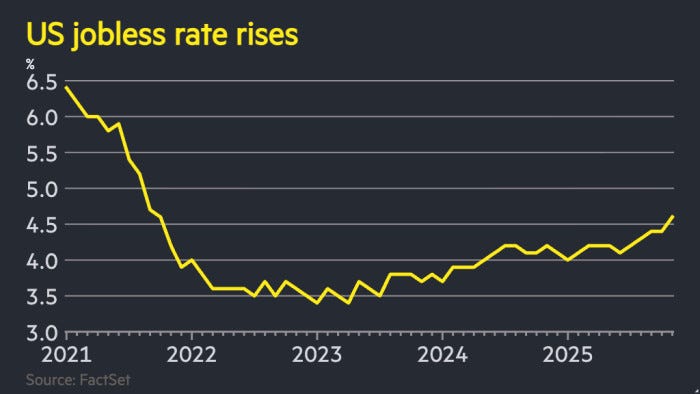

US unemployment rate hits four-year high of 4.6% - The Financial Times

We’ve been waiting for labour market statistics for a while now, and they finally dropped on Tuesday. The picture wasn’t looking great. In October, firms shed over 100,000 jobs and unemployment rose to a four year high of nearly 5%. Jobs were added in November, but the underlying picture is still bad. More than a quarter of consumers are living beyond their means, with their monthly outgoings exceeding their incomes. Yet more evidence that the US economy is, as I argue here, a house of cards, driven by the AI bubble and the spending of the wealthy.

The slowdown in employment is going to increase pressure on the Federal Reserve to cut interest rates. But there’s a problem with this approach: we’re in the middle of a bubble, which is increasingly being driven by debt. If you cut interest rates, you make debt cheaper, which risks encouraging yet more borrowing and exacerbating the bubble.

This is what happens when you get an extremely unequal economy – the normal tools of economic policy stop working as they should. You can’t tax the rich because they’re so wealthy that they have both the means and the incentive to spend vast sums figuring out how to avoid it. And you can’t cut use monetary policy to support the real economy, because the rich just hoover up all the cheap money. The only way all this ends is with a big economic crisis.

Britain’s homes will no longer be one-way gambling chips – The Observer