What I Read this Week

The K-shaped recovery, the war on wealth taxes, and the impact of imperialism on the climate.

Articles

More evidence for my ‘The US Economy is a House of Cards’ theory. The Fed has released its ‘Beige book’, which gathers data from each of the 12 regions in the Federal Reserve system. It showed that economic activity has been increasing, but only because rich people are going out and spending lots of money – partly thanks to a buoyant stock market, driven largely by the AI boom.

Economists are now describing this as a ‘K-shaped recovery’ to reflect the diverging fortunes of the rich and the rest. Several districts reported that spending was higher among higher earners, while low to middle income consumers “were seen to be increasingly price sensitive”. Translation: less well-off people are running out of money to spend on anything other than survival.

This article also quotes Moody’s chief economist, who said earlier this year that spending hasn’t kept pace with inflation since the pandemic for those in the bottom 80% of the income distribution. But for the top 20%, spending has outpaced inflation – and the trend is even starker for those in the top 3%.

There are a few notable things about the K-shaped recovery. First, it makes GDP effectively meaningless as a measure of living standards. GDP is growing and people’s lives aren’t getting better – no matter how much economists want to tell them otherwise. Second, it suggests the recovery is not sustainable. Growth is being supported by debt-fuelled AI investment, which is, in turn, propping up the spending of the rich. When the bust comes, there will be hell to pay.

Thiel Gives $3 Million to Group Seeking to Block California Wealth Tax – The New York Times

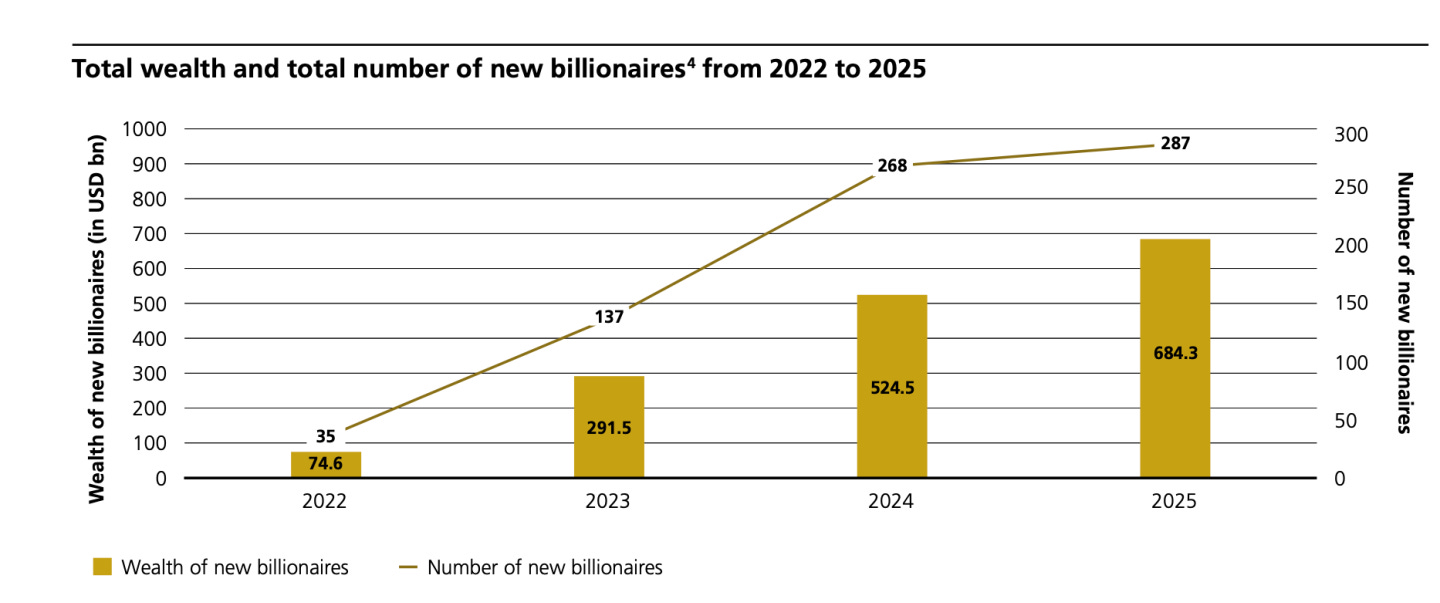

We’re reaching gilded age levels of inequality in the US, and the tech bros still don’t want to pay their taxes. A healthcare union has put forward a wealth tax initiative in response to proposed cuts to healthcare spending. The proposed tax is a 5% levy on the assets of those worth more than $1 billion.